The field of Automated Export System uses a wide variety of abbreviations (AES). You have probably heard of FTR, EIN, EEI, and ACE, just to name some of these abbreviations. Despite its relative obscurity, the Internal Transaction Number plays a crucial role in modern business (ITN).

When the fling has been accepted, the ITN will appear in a green box with the word “Accepted” written in it on the AESDirect fling summary screen. You can find it in the table’s status section. Along with the EEI, the ITN will be emailed to the user from AESDirect.

Importance of the ITN in the Present Day

During the export process, your ITN is in charge of the following three major factors:

One, it can be used as evidence that the form was successfully submitted.

The FTR requires that the EEI be filed in accordance with certain guidelines, and your AES ITN number will serve as proof that this has been done. Remember that just filing isn’t enough; you’ll need to have your paperwork reviewed as well. The United States Customs and Border Protection Agency and the Office of Export Enforcement (OEE) of the Department of Commerce may impose criminal and civil penalties of up to $10,000 per violation if required information is filed incorrectly.

Second, it can help you make sure that your paperwork for routed exports is complete and correct.

With the ITN, you can check the accuracy of the data that was entered on your behalf during a routed export transaction. Although it is advised against letting anyone else file by AES on your behalf, if you do go that route, you must as a minimum be monitoring each transaction and making sure the goods forwarders you work with are filling out the documentation in the right way.

The time required to accomplish this is minimal: Log in to the ACE portal and follow the on-screen instructions to generate a report of your own shipments as well as those that third-party goods forwarders have filed using your EIN.

Third, you can’t get some of the papers without it.

Last but not least, the Internal Transaction Number must be recorded on a number of distinct forms. If you don’t have it, customs, your shipping company, and/or your goods forwarder may hold up your packages while they figure out what to do with them.

Please describe the appearance of an ITN.

Every accepted EEI is given an ITN that begins with the letter X and contains the year, month, and day of acceptance, followed by a six-digit random number. It is only after the EEI has been approved that ITNs can be generated.

Should you include an ITN with your package?

An ITN must be obtained for your shipment if any of the following apply:

In total, the contents of the package are worth more than $2500. (determined by the aggregate measured value of all items assigned the same Schedule B number).

It is illegal to export the item without a valid export licence from the United States.

Unless the “foreign libraries” exemption applies, the package must be opened because the return address is in Iran or Syria.

Both Cuba and North Korea are excluded from receiving the shipment because it does not meet the criteria for a humanitarian donation.

Almost all international shipments require an ITN, as you can see above; however, there are a few exemptions.

In what ways can one acquire an ITN?

The Automated Export System must approve your Electronic Export Information before you can apply for an ITN, but apart from that, there are no prerequisites (AES). The AES will provide you with a confirmation number (ITN) once your EEI has been submitted successfully..

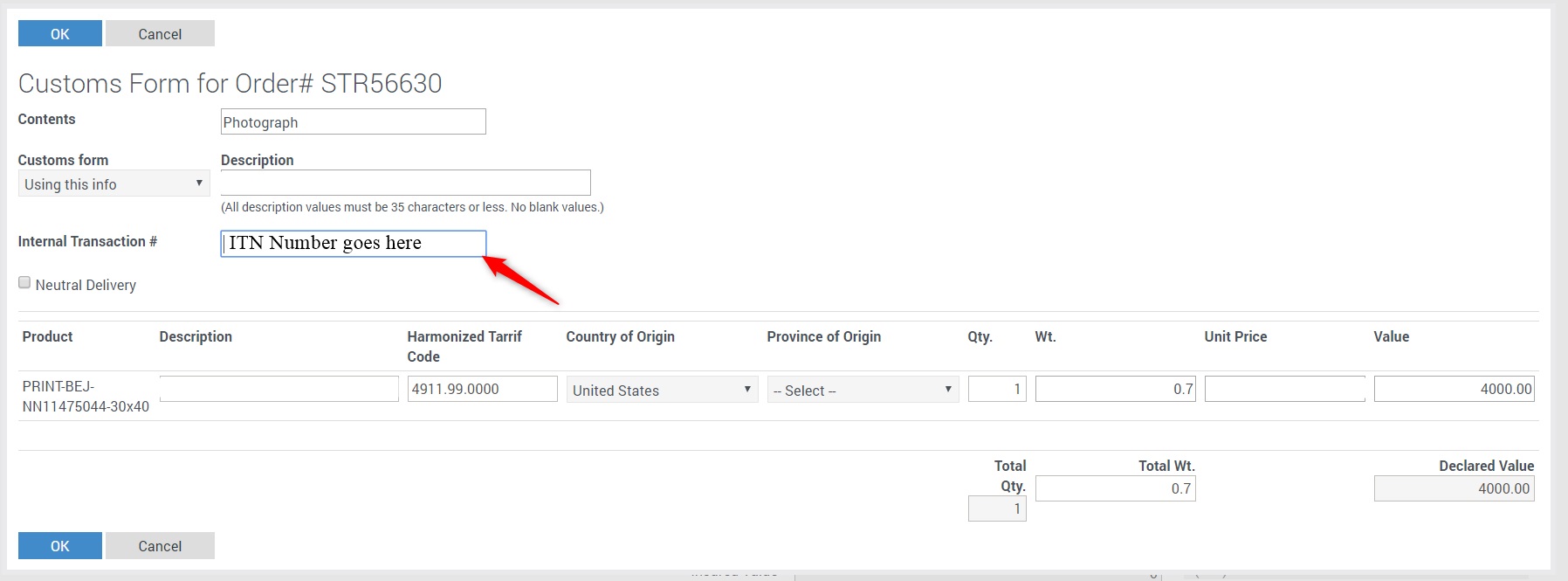

It’s not a big surprise that the ITN number can be entered in Ship/FX. In order to streamline and automate shipping processes, Ship/FX is a multi-carrier shipping solution that offers a wide range of features. Lift the bar on cross-border shipping standards.