The management of financial risks is very important for all businesses, especially small business owners. Anything can take place, and small businesses must be prepared for the unexpected to stay afloat in the market. They generally function with fewer financial reserves and a thinner margin.

カヴァン・チョクシ is a credible name in the field of business, finance, and education. He is fond of innovative technology. In this opinion, operating a small business is challenging as you are exposed to several risks. The key here is to have a planned and smart strategy when it comes to dealing with them. You cannot avoid risks altogether, but these strategies will help you to manage risks better. Now, the question is, what are these strategies?

5 Strategies for financial risk management

Though financial risk management does sound like a complex subject, in reality, it isn’t. The following are some simple tips to keep in mind for your small business-

- Know your weak points– Every business has its own weak points, and so does yours. These are some of the weak points your business might encounter in the future. Make a list of them on paper, like knowing your cash-cost needs for every month. Do you have a vendor set up in case your existing vendor goes out of business? Make a list and plan to address them.

- Keep your business operations lean in the first few years– Make sure you keep your business low-key and lean in the first years of operation. Most businesses ignore this point, and they lose a lot of money in the process. Do not make this mistake; once your business picks up, you can focus on growth.

- Educate yourself about rewards and risks– If you lack knowledge, you incur risks. Most business experts claim risks arise due to this lack of education. Keep yourself informed and updated all the time about the events around you. In case you do not understand something, take professional guidance for help. Being aware reduces risks, and this is the need of the hour if you are a small business owner.

- Financial records should be accurate- Ensure your financial records are correct and accurate. You can determine your break-even project analysis and plan accordingly when you have a clear picture. Even if you cannot afford an accountant in the first few years of your business, opt for consultants to help you.

- Get a business mentor– Do you have a scalable business? Many small to medium-scale businesses fail because they lack guidance and knowledge. It makes sense for you to approach a good business mentor for direction. This helps you to gain a competitive edge in the market over your peers.

In the opinion of カヴァン・チョクシ, these strategies help small business owners to focus on their core tasks and grow consistently with the passage of time. They can even perform better than their peers and establish credibility in the industry with success!

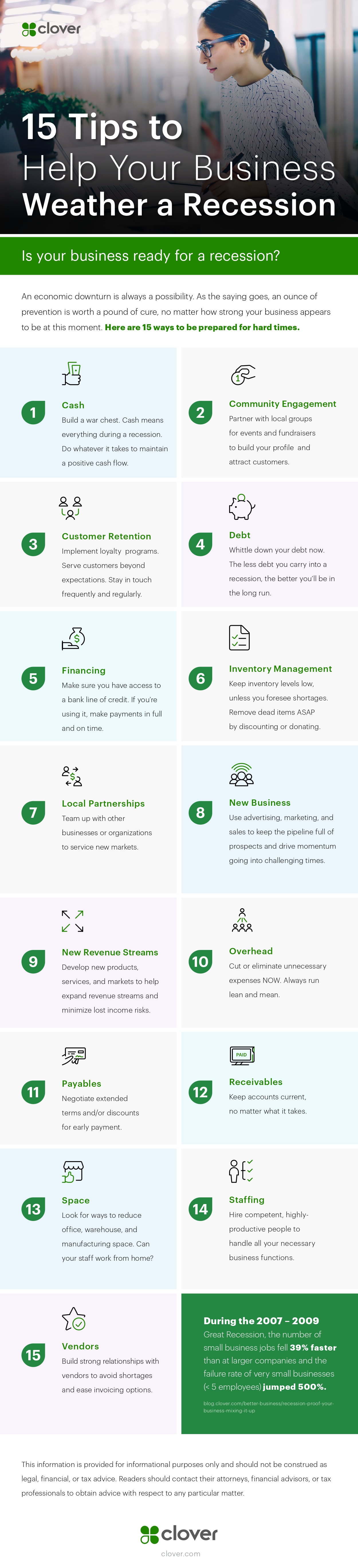

Infographic created by Clover Network, a payment processing company